China’s vacuum industry has evolved through three phases:

2000-2010: Dominated by OEM manufacturing, producing 70% of global vacuums but with 50%, but rural areas

Evolution: From OEM Export to Technological & Branding Breakthroughs

China’s vacuum industry has evolved through three phases:

2000-2010: Dominated by OEM manufacturing, producing 70% of global vacuums but with <5% profit margins;

2011-2020: Brands like Lexy and Ecovacs emerged, launching wireless vacuums (2013) and robot cleaners (2016), boosting domestic penetration to 12%;

2021-2025: Tech explosion—dual-frequency motors and AI navigation became standard. Premium product ASP rose from ¥1,800 to ¥3,200, with 2025 market size projected at ¥48.3 billion (CAGR 11.7%).

Current Landscape: Tripartite Competition & Segment Growth

Three defining trends in 2025:

Market Stratification:

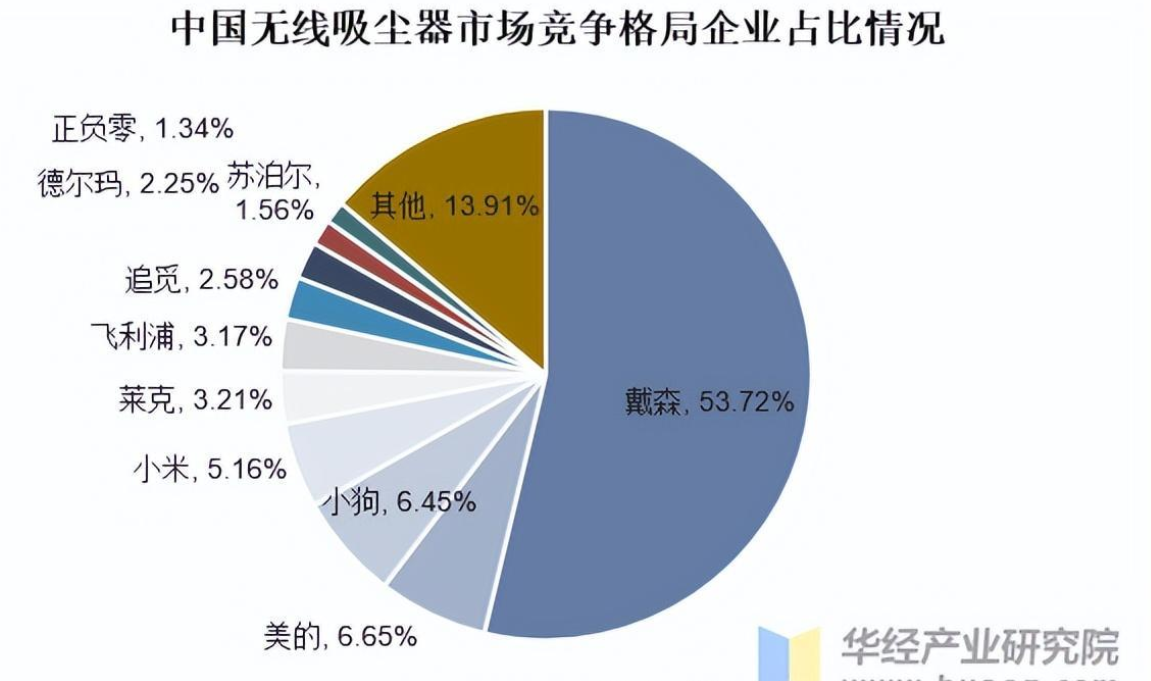

Premium segment (≥¥3,000): MOVA, Dyson, and Dreame hold 78% share, focusing on "mopping + self-cleaning";

Budget segment (¥1,000-2,000): Xiaomi and Midea leverage ecosystem advantages, shipping 8M+ units annually;

Tech Leap:

Suction power surged from 150AW to 250AW, noise reduced to 55dB (vs. national standard 72dB);

60%+ models integrate LiDAR/mmWave sensors, improving path planning efficiency by 40%;

Global Expansion:

Ecovacs acquired Germany’s Proscenic to access European channels, with overseas revenue hitting 35%;

Dreame leveraged TikTok live commerce for 220% growth in Southeast Asia.

Key Players: Strategic Differentiation Redefines the Market

Lexy Electric:

Focused on "car vacuums + EV motors," securing Tesla’s secondary supplier status. Automotive parts revenue rose to 45%;

12.3% R&D investment ratio, holding 627 patents (31% international).

Ecovacs:

Launched the first "whole-home cleaning robot" (¥8,999), integrating vacuuming, mopping, and air purification with 100K+ pre-orders;

Built an AIoT cloud platform with 3.2 daily user interactions and 68% data service margins.

Dreame Tech:

Pioneered "microgravity dust removal" for spacecraft cleaning, partnering with CNSA;

B2B revenue (industrial/medical equipment) exceeded 30% in 2025.

Future Trends: Challenges & Opportunities

Market Imbalance:

Tier 1-2 cities penetration >50%, but rural areas <8%. Solutions like "¥1,000 waterproof vacuums" target farming needs;

Case: Haier’s "livestock farm vacuum" (IP68-rated) saw 170% rural sales growth.

Tech Barriers:

Dyson’s patent lawsuits (23 patents including dual-frequency motors) push local firms toward hydrogen-powered and quantum dust removal tech;

Breakthrough: MOVA’s "electrostatic nano-membrane" with 99.999% filtration efficiency at 60% lower cost.

Ecosystem Wars:

Battles for smart home dominance require HarmonyOS/Vela OS compatibility;

Innovation: Ecovacs opened APIs for third-party plugins like "pet hair removal" and "pollen allergy mode."