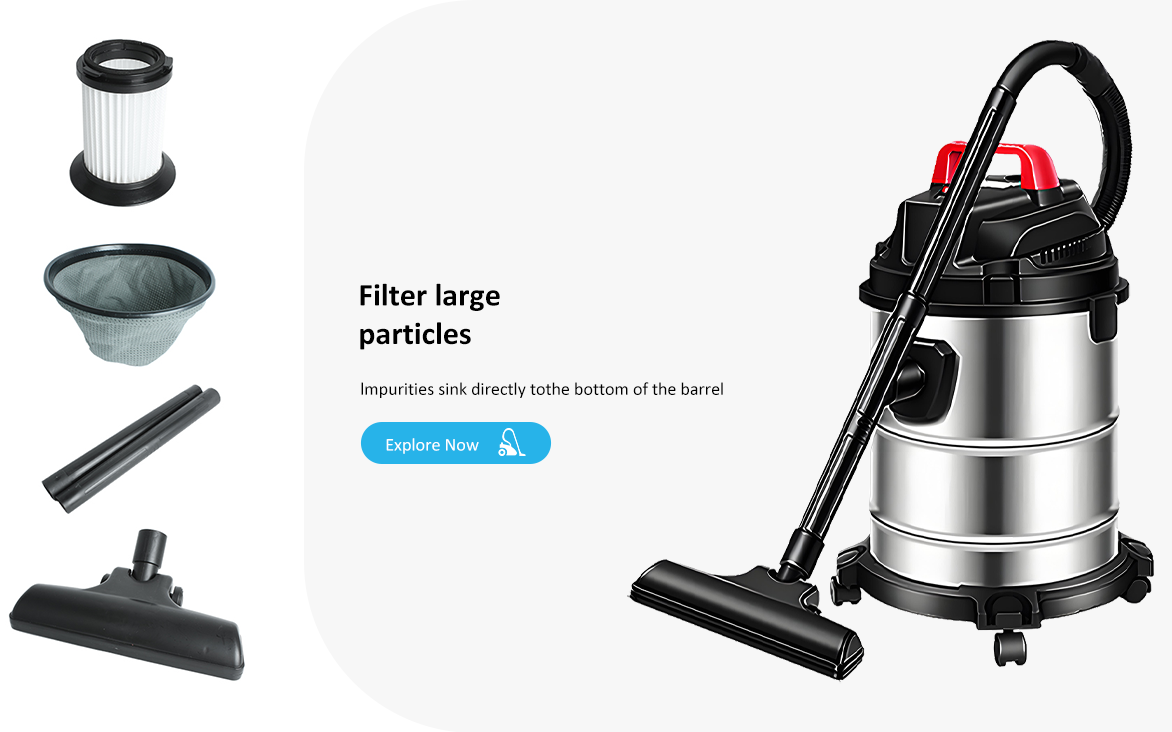

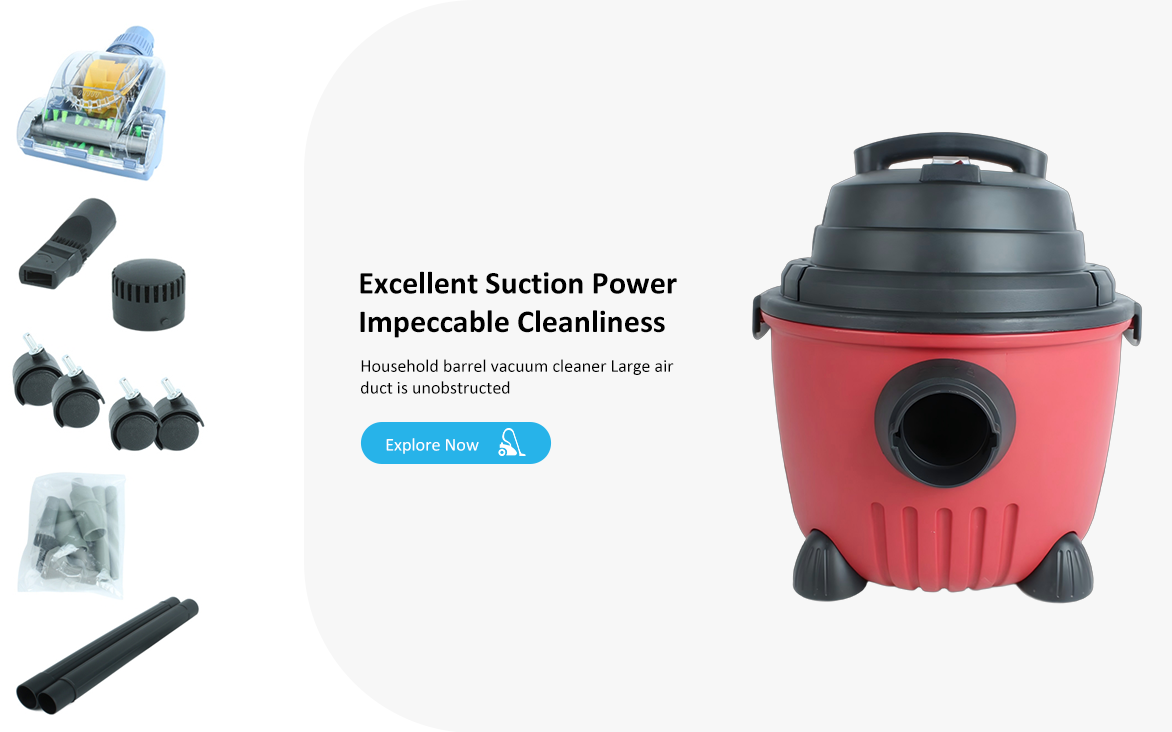

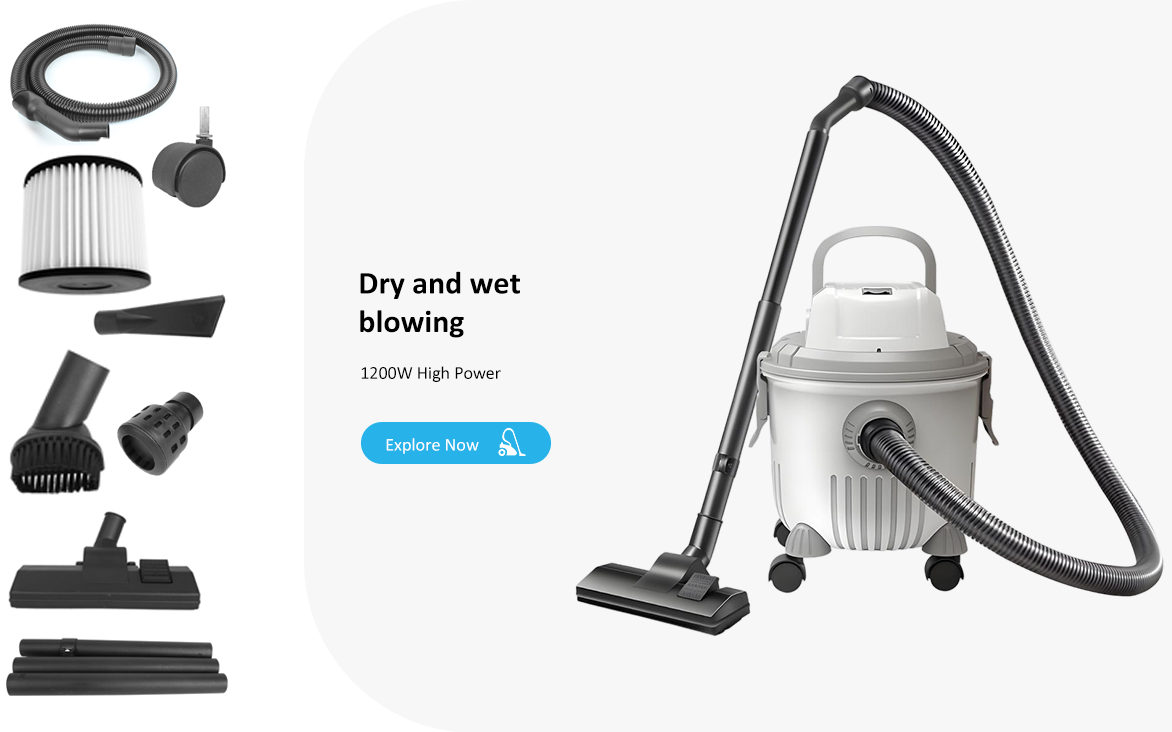

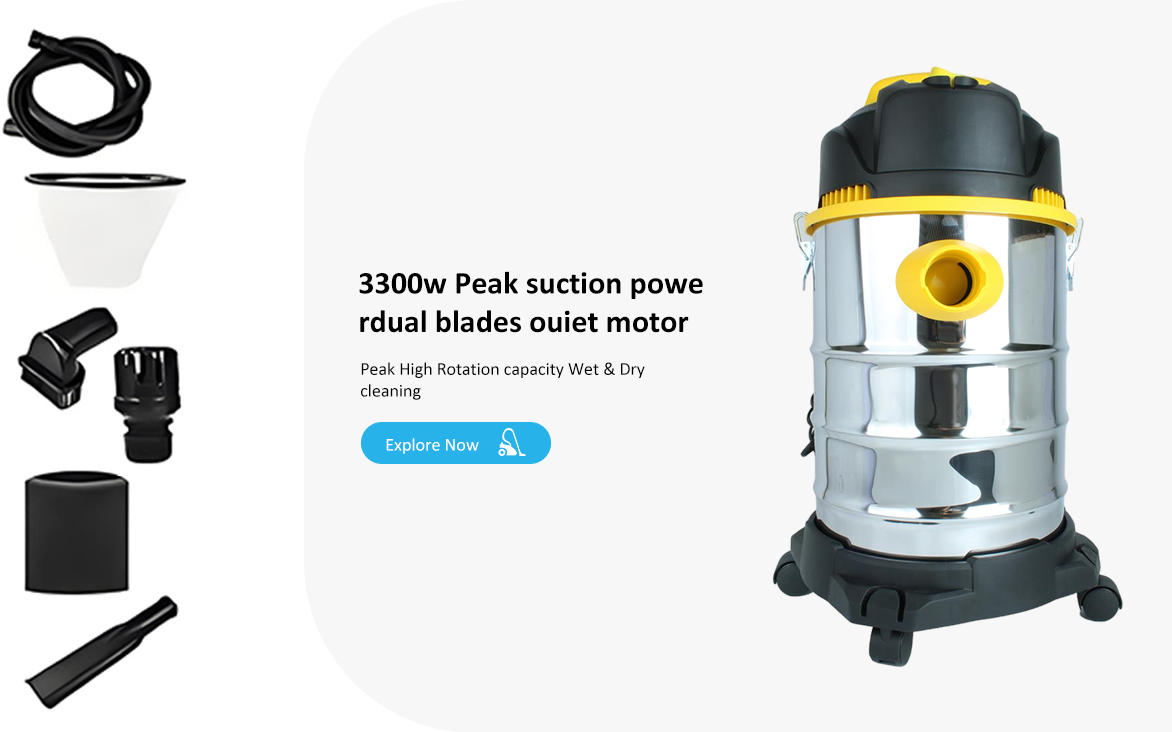

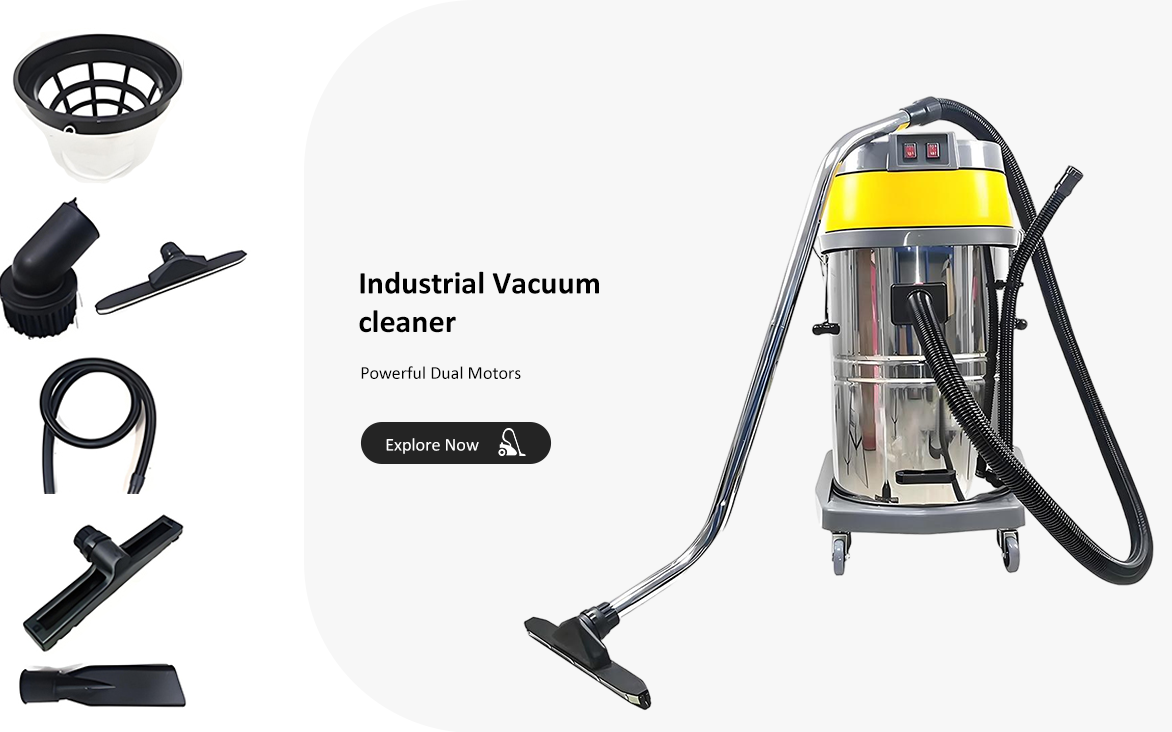

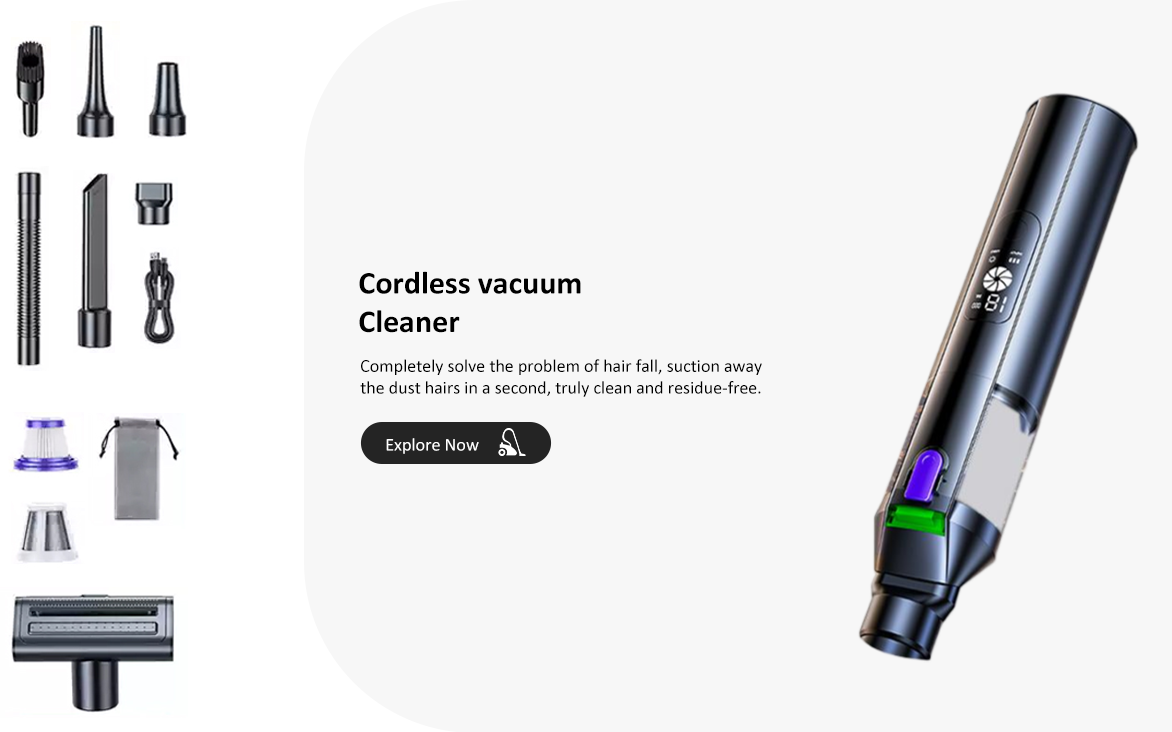

OUR POPULAR PRODUCTS

PRODUCT ADVANTAGES

COMPANY PROFILE

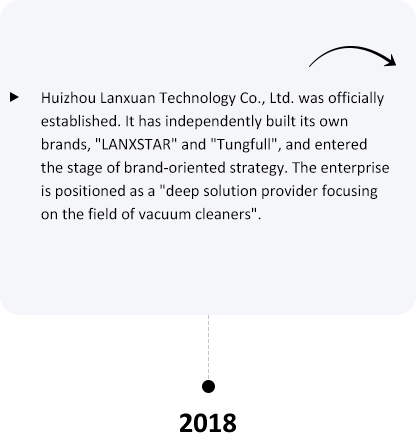

Huizhou Lanxuan Technology Co., Ltd. Founded in 2018 and headquartered in Huicheng District, Huizhou City, Guangdong Province, is a high-tech enterprise specializing in the "research, manufacturing", and "global distribution" of "vacuum cleaner products" and accessories. We are committed to delivering "efficient, durable, practical", and "highly cost-effective" vacuum tool solutions to customers around the world through technological innovation and strict quality assurance.

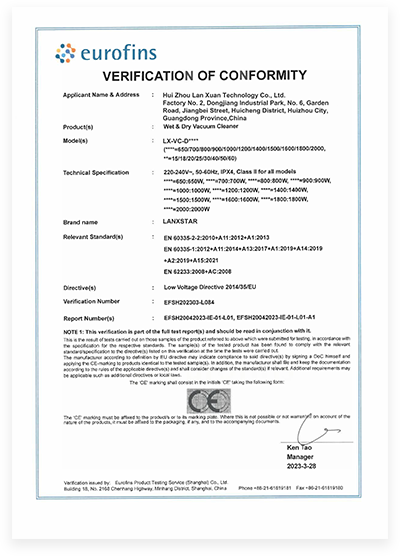

We offer 20 major product categories, covering the entire range of vacuum cleaner components. Our factory covers an area of5,200 square meters, equipped with advanced manufacturing and testing facilities. We are ISO9001-certified and maintain an annual turnover exceeding RMB 320 million. Today, Lanxuan serves as a key supplier to numerous well-known domestic and international brands as well as major cross-border e-commerce platforms.

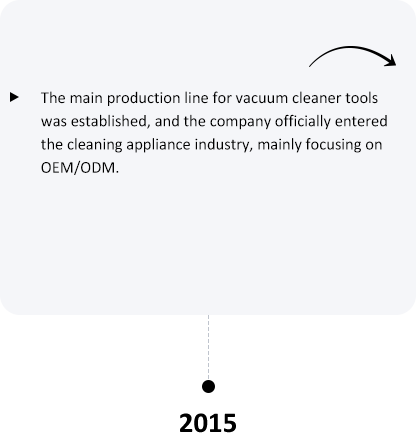

Our main production line has been operational since 2015, giving us nearly a decade of manufacturing experience. Evolving from an OEM supplier to a company with in-house R&D and independent brand development, we have successfully launched our own brands:“Tungfull” and “LANXSTAR”. Our products are now exported to over 30 countries and regions including Europe, US,Southeast Asia, and the Middle East, earning long-term trust from more than 100 global partners.

Backed by a "young, efficient", and "innovative" technical and management team, we have strong capabilities in product development and customized design. We are able to provide personalized and professional product solutions tailored to the specific market environments and user needs of our clients.

MEANINGFUL MOMENTS WITH OUR TEAM

Customer photos

Eight reasons to choose us

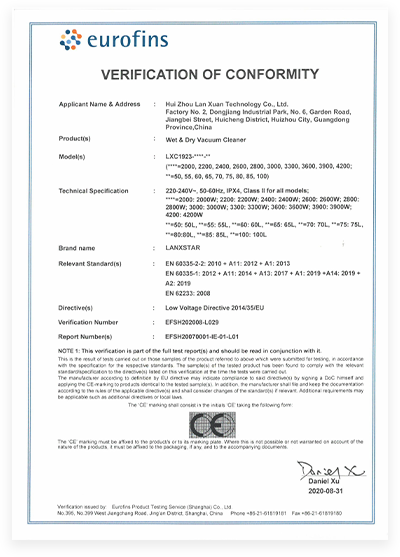

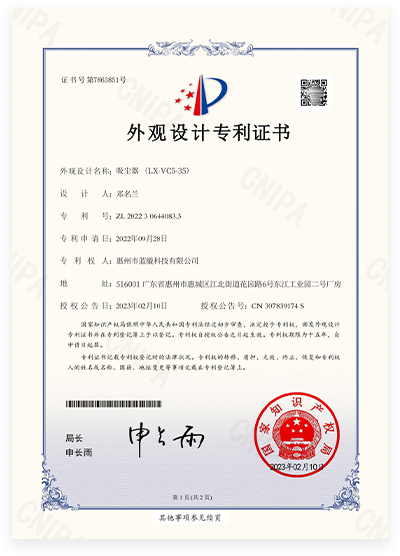

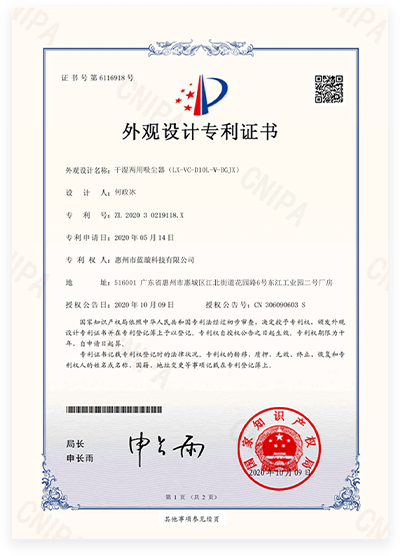

Company certificates

PRODUCT CUSTOMIZATION

THEY CHOOSE US

VIDEO

At Lanxuan, "empowering customer success" is our constant commitment. Guided by customer needs, we "think what customers think, act on what customers need.” Through reliable product quality, flexible customization, and responsive service, we continuously create value for our clients. Lanxuan is more than just a supplier, we are your long-term partner in strategic growth.

Tiktok

LANXSTAR Vacuum Cleaner – International Customer FAQ

Welcome to LANXSTAR support. Here are the most common questions from our international customers about using, maintaining, and troubleshooting your vacuum cleaner.

news

CONTACT OUR FRIENDLY TEAM

Partners

Let's get in touch!